Variable Cost

Variable Cost

A variable cost is a business expense that changes in proportion to how much a company produces and sells its goods and services. Variable costs increase or decrease depending on a company's production or sales volume. Variable costs are directly linked with the production of product and the process of sales to its end customer.

Main features

- Ability to enter beginning and end of cost duration.

- Ability to use up to 12 different variable costs divided into 3 groups

- choose to estimate variable cost based on product revenue or a number of orders

- Overview of all variable costs in one place

- Forsee monthly and yearly forecast on the same sheet.

3 Groups of Variable Costs

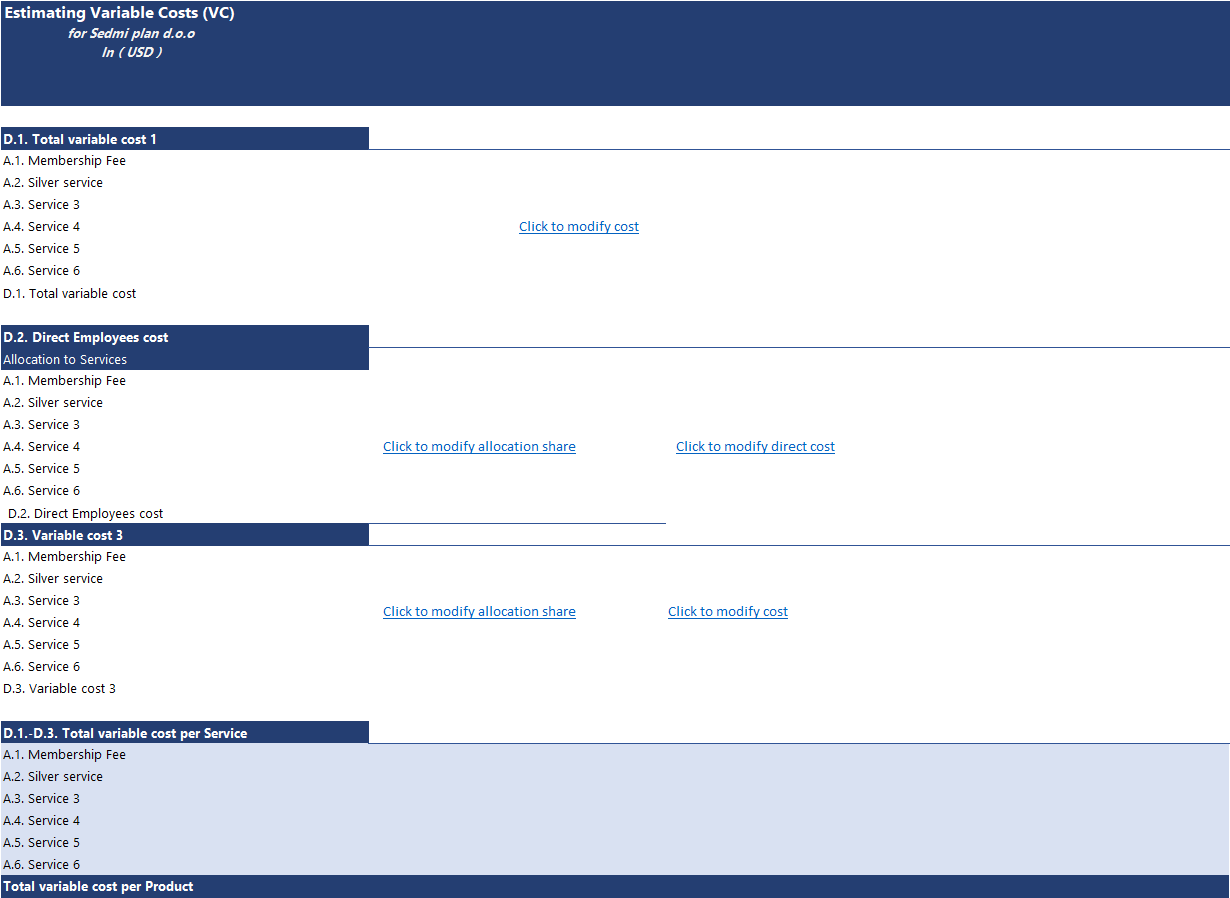

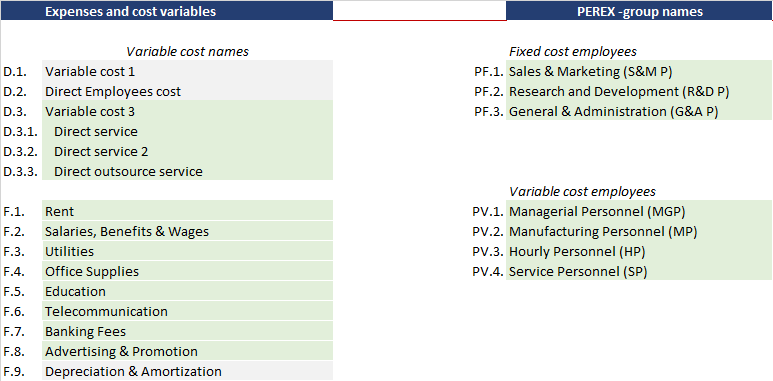

This model has built-in 3 types of variable costs to use for different purposes. The first two variable cost types (cost of goods sold and direct employee costs) are shown in this sheet for reportnig, while the estimation of those costs is done through respective separate sections.

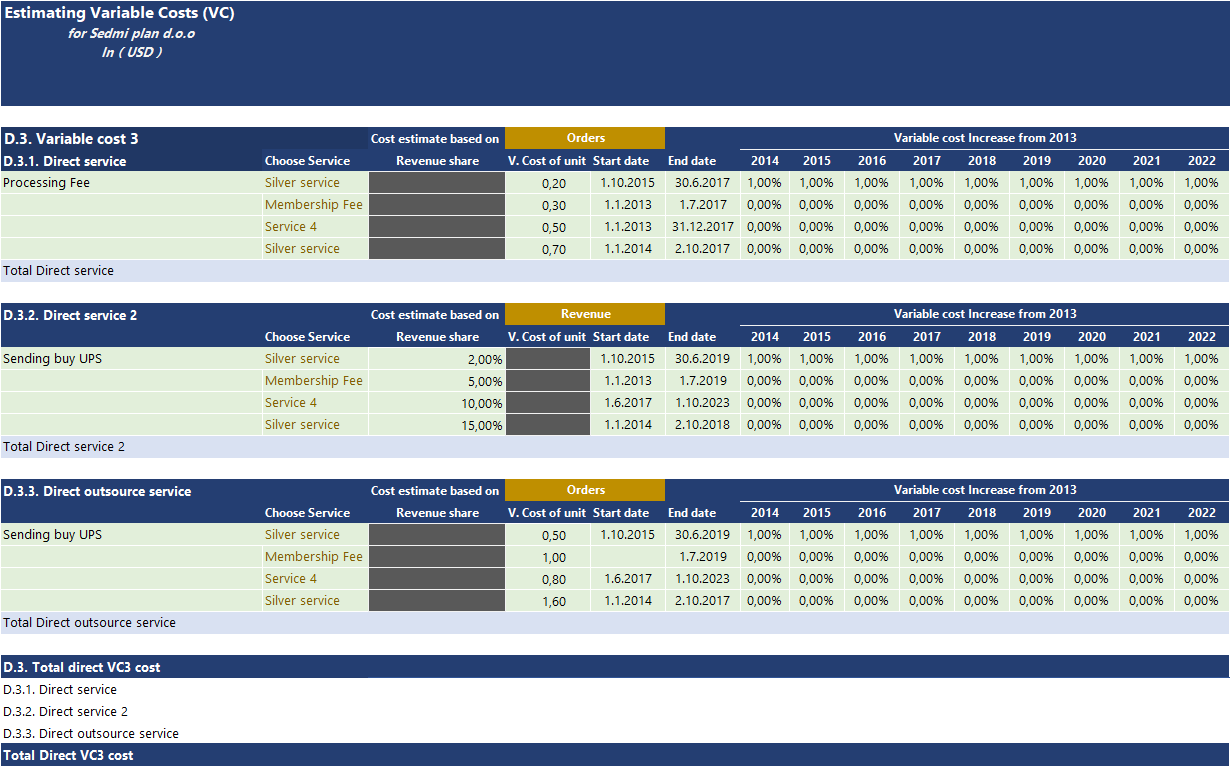

The 3rd group of variable costs is estimated in this section. It is divided into 3 groups with 4 line items costs. Both name cost groups and line-item costs are configurable here and also in the customization section. You can build up direct cost based on a share in particular product revenue (or total revenue), or u can choose to estimate direct cost based on cost price and product orders.

The 3rd group of variable costs is estimated in this section. It is divided into 3 groups with 4 line items costs. Both name cost groups and line-item costs are configurable here and also in the customization section. You can build up direct cost based on a share in particular product revenue (or total revenue), or u can choose to estimate direct cost based on cost price and product orders.

3 Groups of Variable Costs

Cost of goods (service) sold

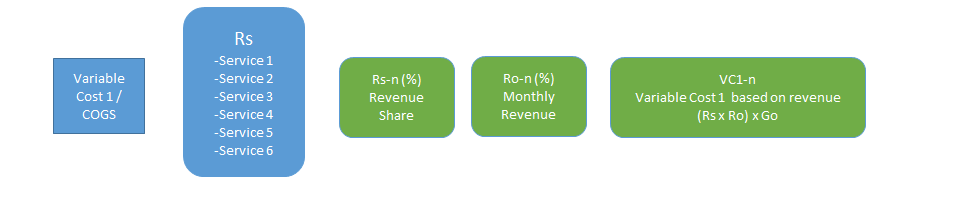

The Cost of goods sold or direct variable cost estimation is done through the Revenue sheet. The model of calculating such cost is a rather strait forward one.

Cost of goods sold (COGS) represents the cost of physical product that has been sold in retail or wholesale sales. It represents the purchased cost that has been recorded on stock and reduced at the time of sales. This cost can be estimated as a percentage of product revenue and it is directly related to revenue.

If your model is based on service (hence you do not plan the movement of stock level), you can use this direct cost for some direct cost that is applied directly on product revenue. One one example of this is the cost of credit card charges or franchise fees you need to pay in order to use a franchise brand. Another example is a white label fee, where you pay to use the platform for Saas products.

If your model is based on service (hence you do not plan the movement of stock level), you can use this direct cost for some direct cost that is applied directly on product revenue. One one example of this is the cost of credit card charges or franchise fees you need to pay in order to use a franchise brand. Another example is a white label fee, where you pay to use the platform for Saas products.

Cost of goods (service) sold

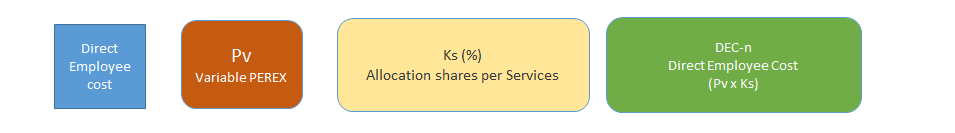

Direct Employees Cost

Direct Employee costs represent those costs that are directly involved with offering services or producing products. Direct employee costs are estimated in the PEREX section of the model and also displayed in this section as a part of total variable costs. The model has 3 groups of Direct employee costs with the same salaries conditions and one managerial group with 4 line managers.

If the financial model is general type then all Direct employee costs are allocated to product or service cost by using percentages in the configuration section. If the financial model is tailored to a specific service, it might have a specific model of estimating direct employee cost that is directly linked to orders or needed personnel to provide such service.

The general model of allocating direct costs example: You are providing web design services to your customers and employ 3 designers, programer, and team leaders. You have 3 service levels depending on the complexity of the service. At the end of the year, you estimate how much each employee contributes to your service and that reallocate their salaries to the product accordingly by using the reallocation percentage in the configuration section.

If the financial model is general type then all Direct employee costs are allocated to product or service cost by using percentages in the configuration section. If the financial model is tailored to a specific service, it might have a specific model of estimating direct employee cost that is directly linked to orders or needed personnel to provide such service.

The general model of allocating direct costs example: You are providing web design services to your customers and employ 3 designers, programer, and team leaders. You have 3 service levels depending on the complexity of the service. At the end of the year, you estimate how much each employee contributes to your service and that reallocate their salaries to the product accordingly by using the reallocation percentage in the configuration section.

Direct Employees Cost

Direct Variable Cost (modular)

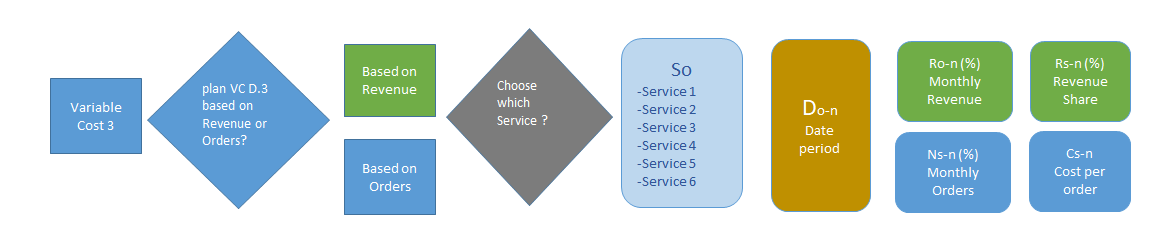

This section of variable cost (VC) estimation is the most customized one. There are 3 VC group types with 4 cost items for you to customize to your need.

You can choose to estimate cost based on the total revenue of a particular product or total company revenue. For example, you can use it to estimate credit card processing fees for different product types.

You can choose to estimate cost based on the total orders of a particular product or total company. For example, you can estimate the cost of post and packaging by using the number of orders and the cost of orders.

Depending on which estimate method you use, the not-used input drivers' cell will be shaded in gray, while the needed driver's cell will remain to be in green color.

Depending on which estimate method you use, the not-used input drivers' cell will be shaded in gray, while the needed driver's cell will remain to be in green color.

Direct Variable Cost

Entering Assumptions

Let's take an example of running a hosting company and want to develop a financial model for estimating direct costs that are associated with such service. For simplicity, we will choose only two services, one is web hosting and the other is data storage for accounting backup software.

Firstly, you need to take into consideration all direct costs that are involved in offering such service.

1. Server: usually you rent a rack with certain CPU power, Data storage, and bandwidth and pay on monthly basis. You will buy two racks with different performances. One, more expensive for delivering high speed for hosting and the other for data storage. Here you can use the estimation of direct cost per web hosting and data storage product revenue.

2. Virus and Malware protection or Cpanel license. It is usually priced per server. However, you can convert it to cost per max capacity of 50 customers @ one server. If you increase the number of servers in the forthcoming years, then you can reduce the initial cost of protection per client. Just be careful to take into consideration the inflation effect too.

3. Credit card processing Fee or chargebacks. it is done as a percentage of revenue per product.

4. Customer service platform: If you are using another online platform to handle customer ticketing, you can convert it to cost per user and apply it.

5. Additional disk space for storage. the cost of additional storage space will be converted into cost per user and applied to the cost model by using orders for data hosting products.

An increase in the base price is important to estimate in every estimation cost model. While trying to estimate costs, we use a percentage increase from base cost in the first year (contrary to the revenue estimation where we used an increase on year on year basis). If you estimate the 10% increase in base price in the first year and all following year then it means that the cost price we use in the first year will increase by 10% in the second year and remain the same throughout the future period. If you chose to put an increment of 5% each year (5%,10%, 15%,20%,...) it means that you estimate a 5% increase in cost price per year.

Firstly, you need to take into consideration all direct costs that are involved in offering such service.

1. Server: usually you rent a rack with certain CPU power, Data storage, and bandwidth and pay on monthly basis. You will buy two racks with different performances. One, more expensive for delivering high speed for hosting and the other for data storage. Here you can use the estimation of direct cost per web hosting and data storage product revenue.

2. Virus and Malware protection or Cpanel license. It is usually priced per server. However, you can convert it to cost per max capacity of 50 customers @ one server. If you increase the number of servers in the forthcoming years, then you can reduce the initial cost of protection per client. Just be careful to take into consideration the inflation effect too.

3. Credit card processing Fee or chargebacks. it is done as a percentage of revenue per product.

4. Customer service platform: If you are using another online platform to handle customer ticketing, you can convert it to cost per user and apply it.

5. Additional disk space for storage. the cost of additional storage space will be converted into cost per user and applied to the cost model by using orders for data hosting products.

An increase in the base price is important to estimate in every estimation cost model. While trying to estimate costs, we use a percentage increase from base cost in the first year (contrary to the revenue estimation where we used an increase on year on year basis). If you estimate the 10% increase in base price in the first year and all following year then it means that the cost price we use in the first year will increase by 10% in the second year and remain the same throughout the future period. If you chose to put an increment of 5% each year (5%,10%, 15%,20%,...) it means that you estimate a 5% increase in cost price per year.

Direct Employees Cost

Changing names

All names of cost groups or line item costs can be changed according to your need. In the configuration section, you can change the name of the direct employee group, while line item costs can be changed in this variable cost section.

Direct Variable Cost

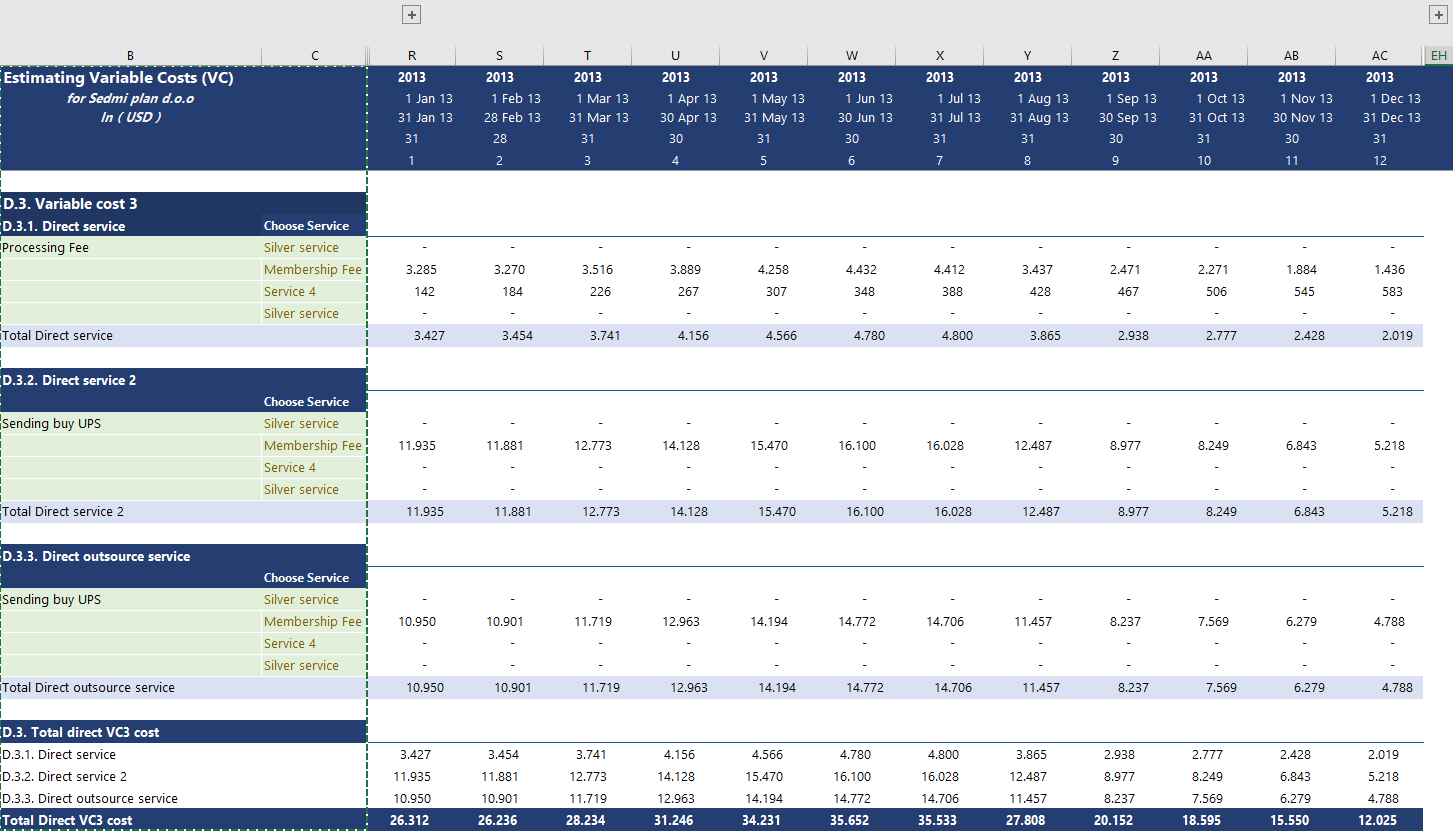

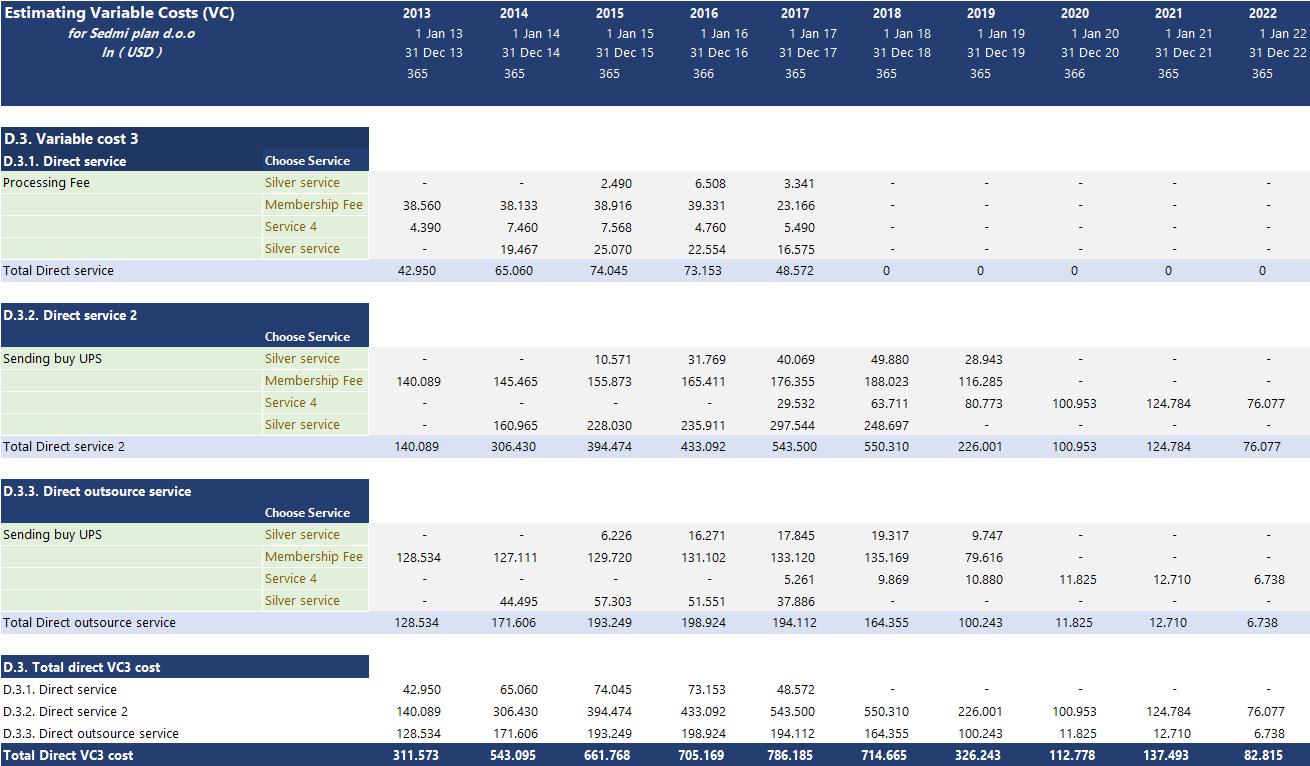

Overview reports

Once you enter all drivers for estimating direct costs, you can see if your drivers meet your planned monthly or yearly direct cost targets in money terms.