Business Valuation

Business Valuation

This section is about SME business valuation. There are generally acceptable methods of evaluating healthy business which has an ongoing principle.

Main features

- 2 different methods of valuation.

- Automatic computation of discount factor, based on your input

- Enterprise value uses a two-stage model with a terminal value

- possibility to add additional risk factors such as country risk, small company, less liquidity.

How to value your business

Business valuation assumptions are an important part of estimating the value of the business today given all assumptions we have entered into our financial model. The model does not take into account the probability of occurrence for drivers and it relies upon estimated Free cash flow throughout estimate horizon and compensation for future business growth.

We are not going to explain in detail the financial theory behind it (at least not here in guidelines) but we will simply explain what kind of parameters you need to enter to get an estimate.

Generally, you can choose between two methods;

1. Direct Equity Method

2. Direct Investment Method

The direct equity method uses free cash flow to the owners of equity holders, which is left after preference shares are being paid. This method estimates how much is the company is valued by Equity holders. Using this method, we apply to discount factor (cost of capital) only on equity holders' desirable return on equity.

The direct Investment method uses free cash flow to all invested capital parties, including the loan obligations. Since we want to know the value of all investors (debt and capital holders), we calculate the weighted average of capital cost (WACC) by using the CAMP model.

If you finance a business growth with a combination of debt and equity, you may use the direct equity method.

The business valuation model automatically generates Free cash flow depending on your method and takes the appropriate discount factor (DF).

All assumption regards the computation of DF is taken from model's Configuration section.

The business Valuation Model takes into consideration the following;

- Free cash flow (depending on chosen method)

- Discounted factor (depending on chosen method -WACC, CAPM -Darmodian approach)

- Residual (terminal) value ( Gordon model)

- Discount for non-marketability

The direct Investment method uses free cash flow to all invested capital parties, including the loan obligations. Since we want to know the value of all investors (debt and capital holders), we calculate the weighted average of capital cost (WACC) by using the CAMP model.

If you finance a business growth with a combination of debt and equity, you may use the direct equity method.

The business valuation model automatically generates Free cash flow depending on your method and takes the appropriate discount factor (DF).

All assumption regards the computation of DF is taken from model's Configuration section.

The business Valuation Model takes into consideration the following;

- Free cash flow (depending on chosen method)

- Discounted factor (depending on chosen method -WACC, CAPM -Darmodian approach)

- Residual (terminal) value ( Gordon model)

- Discount for non-marketability

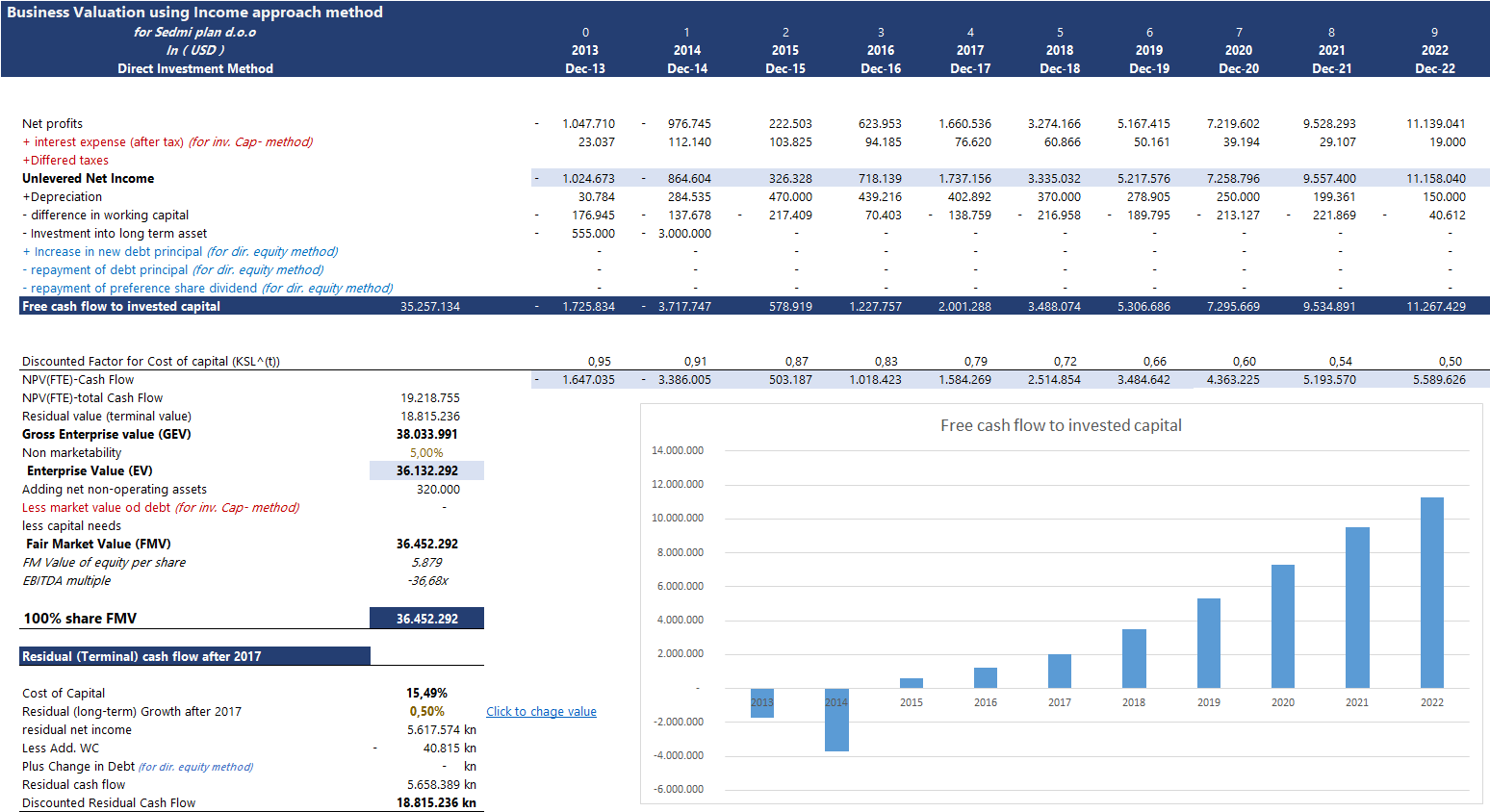

Business valuation sheet

Discounted factor (DF)

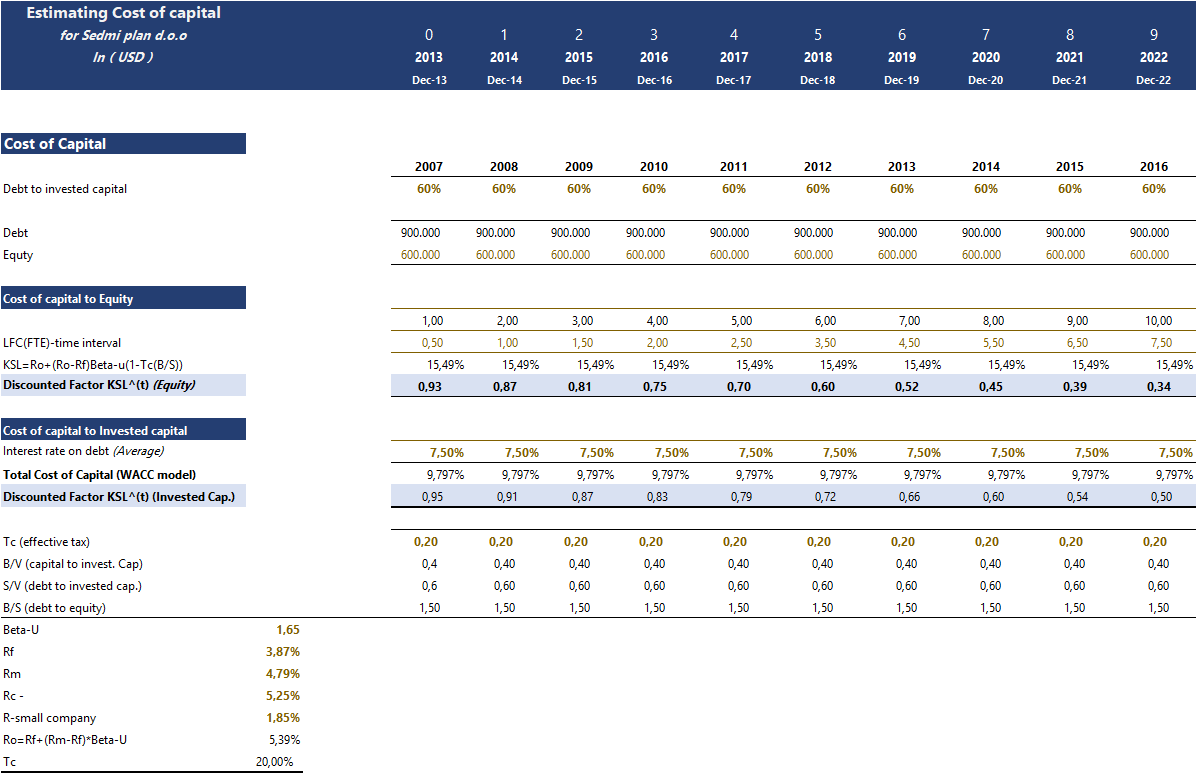

The discounted factor represents the cost of capital and it is calculated depending whatever you choose the Direct investment or Equity method.

If you choose a direct investment, then the cost of capital will take into consideration both debt and equity and use the WACC method to derive an approximation of a weighted average DF.

If you choose an Equity method, then it will use only the cost of capital to equity holders and use the CAMP model to derive to approximation of DF. Besides a standard CAMP model parameters, we use additional risk factors such as Country risk and risk for small companies (Darmodian approach)

All DFs is calculated automatically, depending on your input factors. If you choose a direct investment, then the cost of capital will take into consideration both debt and equity and use the WACC method to derive an approximation of a weighted average DF.

If you choose an Equity method, then it will use only the cost of capital to equity holders and use the CAMP model to derive to approximation of DF. Besides a standard CAMP model parameters, we use additional risk factors such as Country risk and risk for small companies (Darmodian approach)