CAPEX

Capital Expenditure (CPEX)

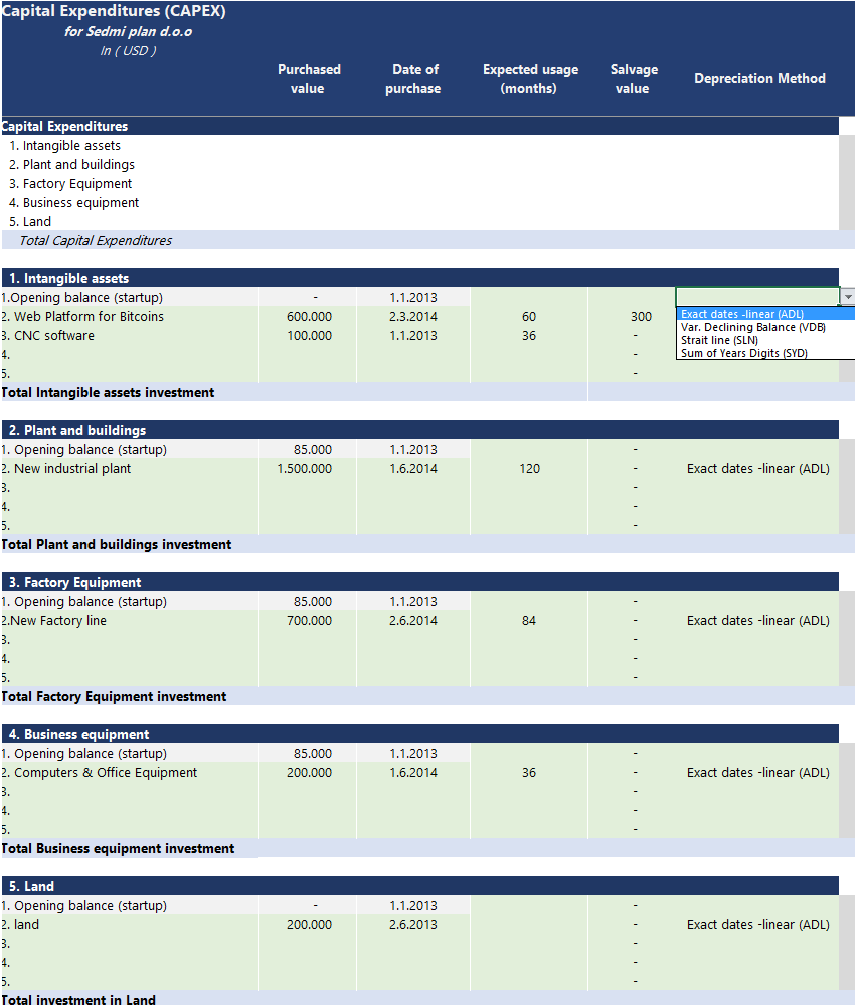

This sheet is starting position for entering your capital expenditure for your new startup business. Besides the business idea, it is far the most important building block of the entire financial model. In general, startup projects require substantial investment into the company asset and we design it to help you to understand the concept.

Main features

- Investment categories are grouped according to financial reporting standards.

- 25 unique investment positions

- 4 different depreciation methods

- Ability to estimate the salvage amonut

Major investment into business

Before you start a project, you need to carefully plan your investment into assets. Some projects fail because entrepreneurs failed to acknowledge important investments into tools, machinery, buildings, software, hardware. Other projects failed because they failed to plan reinvestment of depreciated assets that need to be replaced.

Before you start entering needed investment, you need to build a total list of needed tangible and intangible assets and the time horizon of invesmtnet.

The model has 5 general asset groups with 5 line items for specific asset types. These categories are in line with financial reporting standards (IFRS or GAP) and it is important to enter line items into exact categories.

Required information:

- name of assets

- date of purchase (for simplicity, we consider the date of using an asset equal to purchase date)

- purchased value

- expected lifetime in months (what its expected useful life of the asset)

- expected bookkeeping value at the end of asset life

- depreciation method (formula for estimating accounting value of the asset)

Before you start entering needed investment, you need to build a total list of needed tangible and intangible assets and the time horizon of invesmtnet.

The model has 5 general asset groups with 5 line items for specific asset types. These categories are in line with financial reporting standards (IFRS or GAP) and it is important to enter line items into exact categories.

| 1. Intangible assets |

| 2. Plant and buildings |

| 3. Factory Equipment |

| 4. Business equipment |

| 5. Land |

Required information:

- name of assets

- date of purchase (for simplicity, we consider the date of using an asset equal to purchase date)

- purchased value

- expected lifetime in months (what its expected useful life of the asset)

- expected bookkeeping value at the end of asset life

- depreciation method (formula for estimating accounting value of the asset)

First 4 expense categories

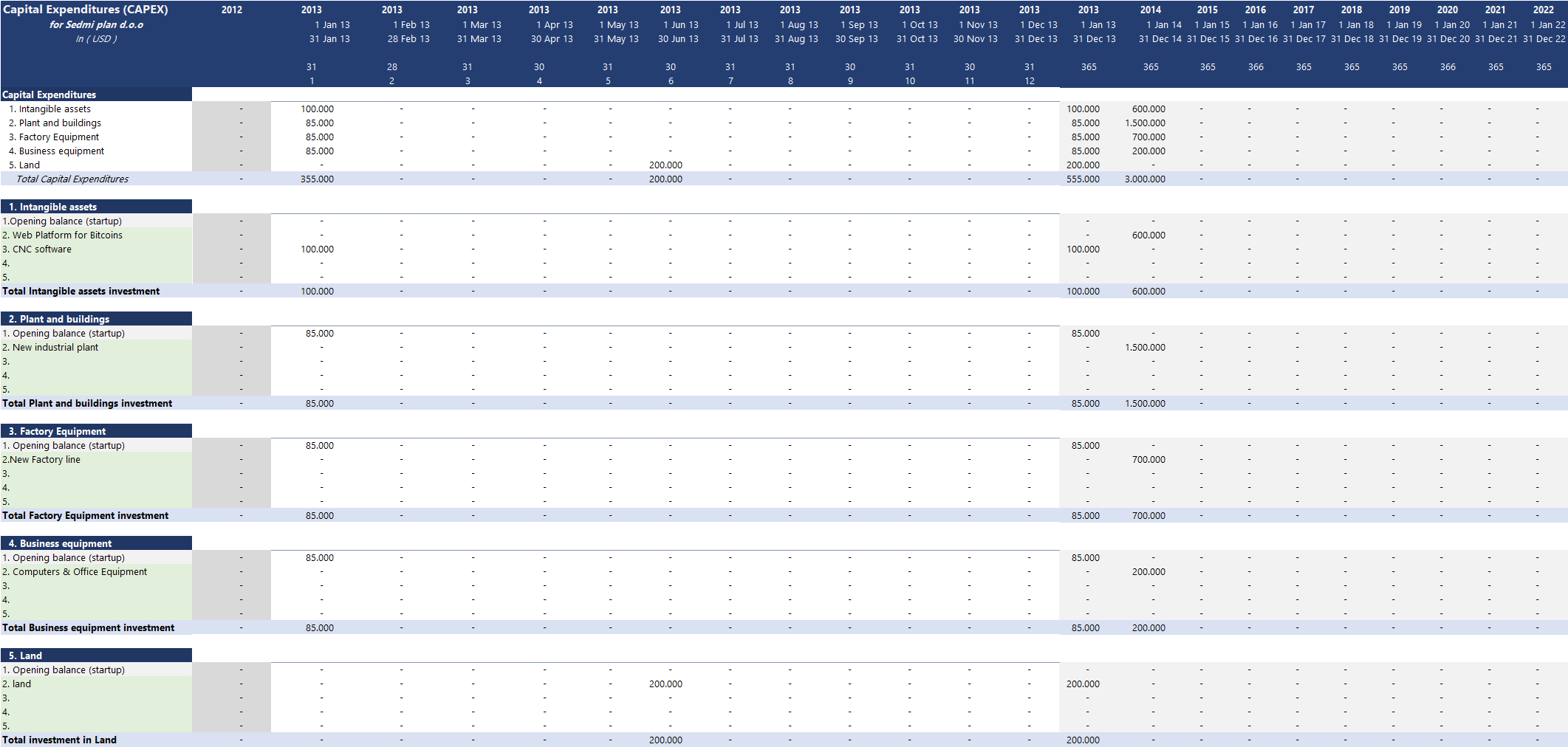

Report overview

Once you enter all investment information for your project, you can see your planned monthly or yearly investment over time.