Financing

Financing Business

Financing business activities usually comes from owners' capital, bank loans, investors' shares with or without voting rights, and the company's cash flow. Controlling a cash flow is the far more important operational activity, once you are on the right market. It is not only the matter of having an adequate level of funds but also when do you have it.

Main features

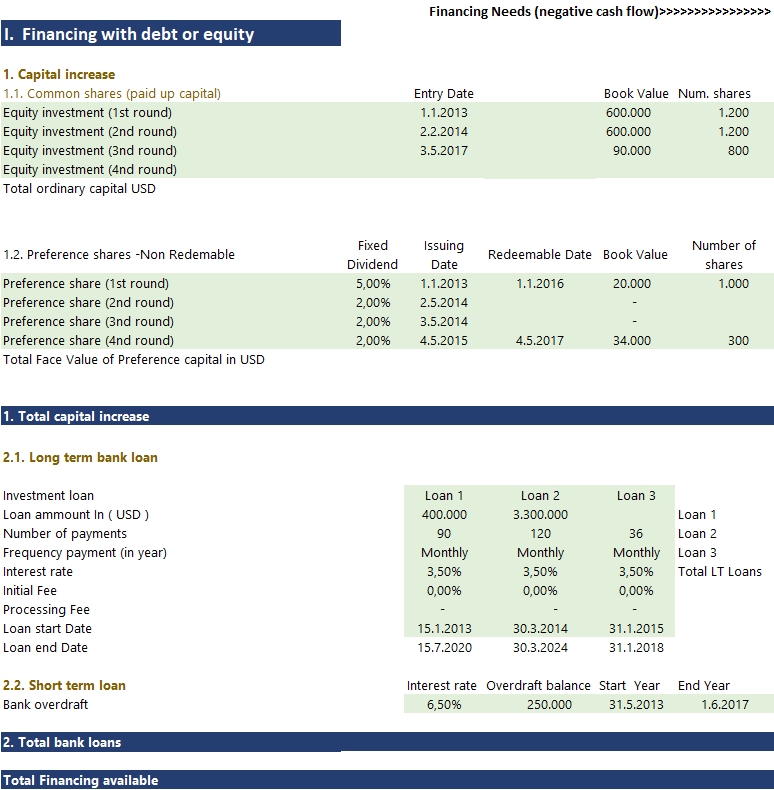

- Ability to use 4 rounds of equity investment

- Ability to use financing with preference shares (redeemable/ non-redeemable; cumulative/non-cumulative)

- 3 Bank investment loans with monthly, quarterly, semi-annual and annual payments.

- Short-term overdrafts loans

- Forsee monthly and yearly forecast on the same sheet.

Financing options

Once when you finished estimating revenue, expenses, and investment into the business, on this sheet you will see a financing gap that needs external financing. Negative cash flow usually happens due to several reasons:

- Business operation needs substantial investment on the startup (capital intensive projects)

- you are developing new products and have a longer time to market.

- Starting a business in a new market and you need to invest in marketing

- Your products need a longer time to reach an adequate revenue stream, while you keep running fixed and variable costs.

Whatever the reason is, you need external financing in order to fuel your business growth, up to the point where the company reaches the point of self-financing and repaying debt obligation.

The model has built in 3 sources of financing:

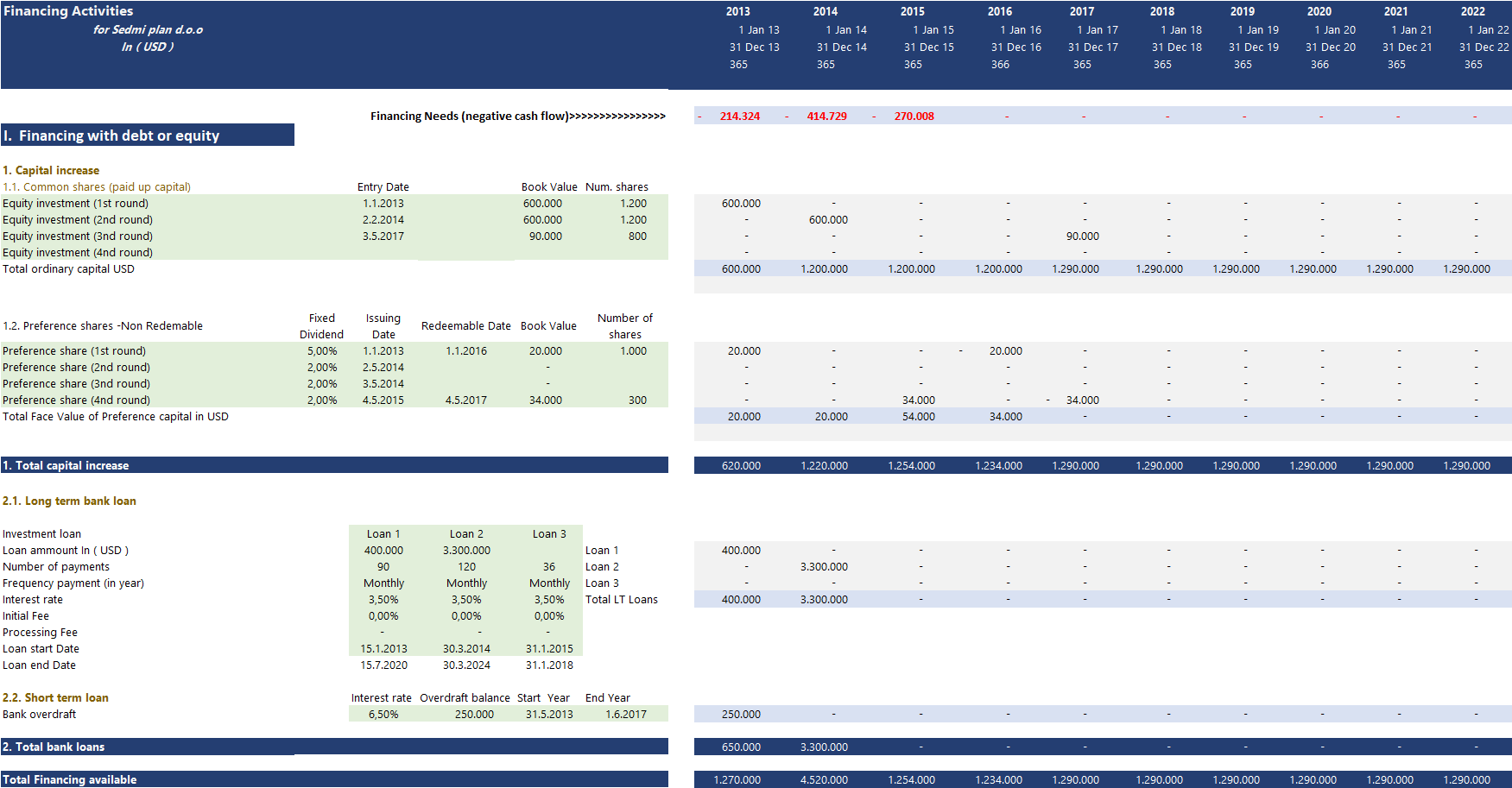

- issuing equity capital (4 rounds of equity investments)

- issuing preference shares ( 4 rounds of preference shares)

- using bank loans for the long and short term (3 long-term 1 short term loan)

Settings for dividend policy for equity holders and preference share type are placed in the Configuration section of the model. The model supports 4 types of preference shares; (non) redeemable and (non) cumulative.

Structuring financing facilities for business growth is not a straightforward activity, and it really depends on many factors:

- Business strategy to enable business growth

- Planned level of growth and timing of milestones

- the market type

- what kind of products or services do you offer

- economic conditions

- creditworthiness and ability to secure additional collateral

- owners exit strategy

- Business operation needs substantial investment on the startup (capital intensive projects)

- you are developing new products and have a longer time to market.

- Starting a business in a new market and you need to invest in marketing

- Your products need a longer time to reach an adequate revenue stream, while you keep running fixed and variable costs.

Whatever the reason is, you need external financing in order to fuel your business growth, up to the point where the company reaches the point of self-financing and repaying debt obligation.

The model has built in 3 sources of financing:

- issuing equity capital (4 rounds of equity investments)

- issuing preference shares ( 4 rounds of preference shares)

- using bank loans for the long and short term (3 long-term 1 short term loan)

Settings for dividend policy for equity holders and preference share type are placed in the Configuration section of the model. The model supports 4 types of preference shares; (non) redeemable and (non) cumulative.

Structuring financing facilities for business growth is not a straightforward activity, and it really depends on many factors:

- Business strategy to enable business growth

- Planned level of growth and timing of milestones

- the market type

- what kind of products or services do you offer

- economic conditions

- creditworthiness and ability to secure additional collateral

- owners exit strategy

Financing assumptions

Report overview

To have a better overview of planning activity, we placed monthly and yearly financial outcomes on the same sheet. You can see when did you plan a new equity round, Bank loan, and whatever you will overcome the cash flow gap on the top of the Financing sheet.

If you want to see more detail about your equity investment, IRR, business valuation, other financial data concerning equity holders, you can go to Business Valuation Dashboard.

If you still have a cash flow gap, then try the following;

- improve self-financing by changing your revenue and expenses assumption

- inspect your large investment and if possible split it into several smaller investments

- increase financing by Bank loan if possible

- Increase or change the date of equity rounds

If you want to see more detail about your equity investment, IRR, business valuation, other financial data concerning equity holders, you can go to Business Valuation Dashboard.

If you still have a cash flow gap, then try the following;

- improve self-financing by changing your revenue and expenses assumption

- inspect your large investment and if possible split it into several smaller investments

- increase financing by Bank loan if possible

- Increase or change the date of equity rounds

Report overview

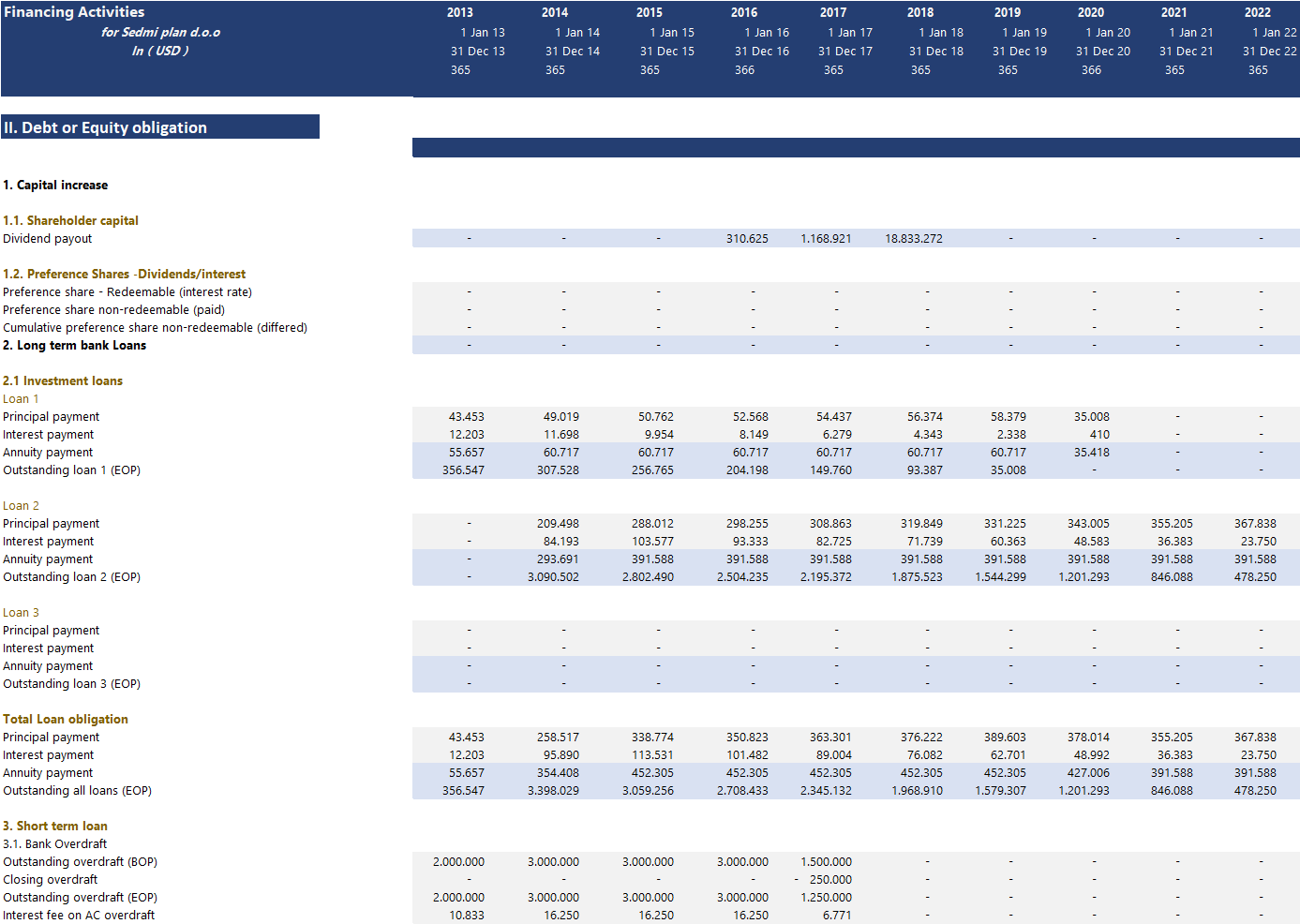

Outstanding obligations overview

Ok, you have managed to overcome a negative cash flow by placing the right financing structure that goes along with your business plan. The second overview report will outline planned debt and equity obligation that arises from your financial plan.

If all conditions of the financial plan are met, then you will have no problem delivering such financial covenants. This model does not have a built probability of an outcome for cash flow, so make sure your plan is achievable and flexible enough to overcome future not foreseen activities.

If all conditions of the financial plan are met, then you will have no problem delivering such financial covenants. This model does not have a built probability of an outcome for cash flow, so make sure your plan is achievable and flexible enough to overcome future not foreseen activities.