Introduction

How to build a financial plan

This is an introduction to the financial model for startup projects or businesses. If you already purchased our MS Excel version of a financial model for a startup, here you can find a detailed walkthrough of all-important building blocks for developing a financial plan with key KPI and business valuation.

Main features

- Revenue and customer growth is based on units, price, churn rate, start and end date, also seasonality of both units and price

- Financing options: equity rounds (4), preference shares, long term loans, and overdrafts

- Detail investment assumption and 4 types of amortizations methods

- Business Valuations and calculation of discounting factors

- Financial model build in MS Excel

- 15 blocks of building a financial plan

- The planning horizon is 5 and 10 years, on a monthly bases

- Automatic calculation of all reports

- A detailed look into a monthly and yearly forecast of operational and financial data

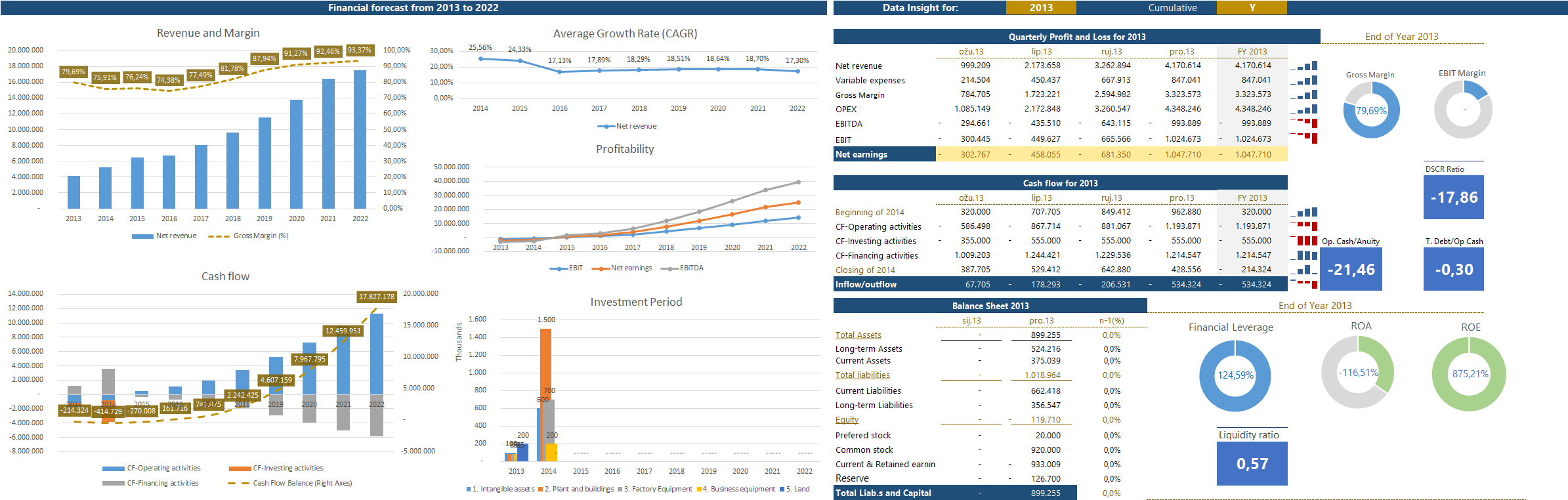

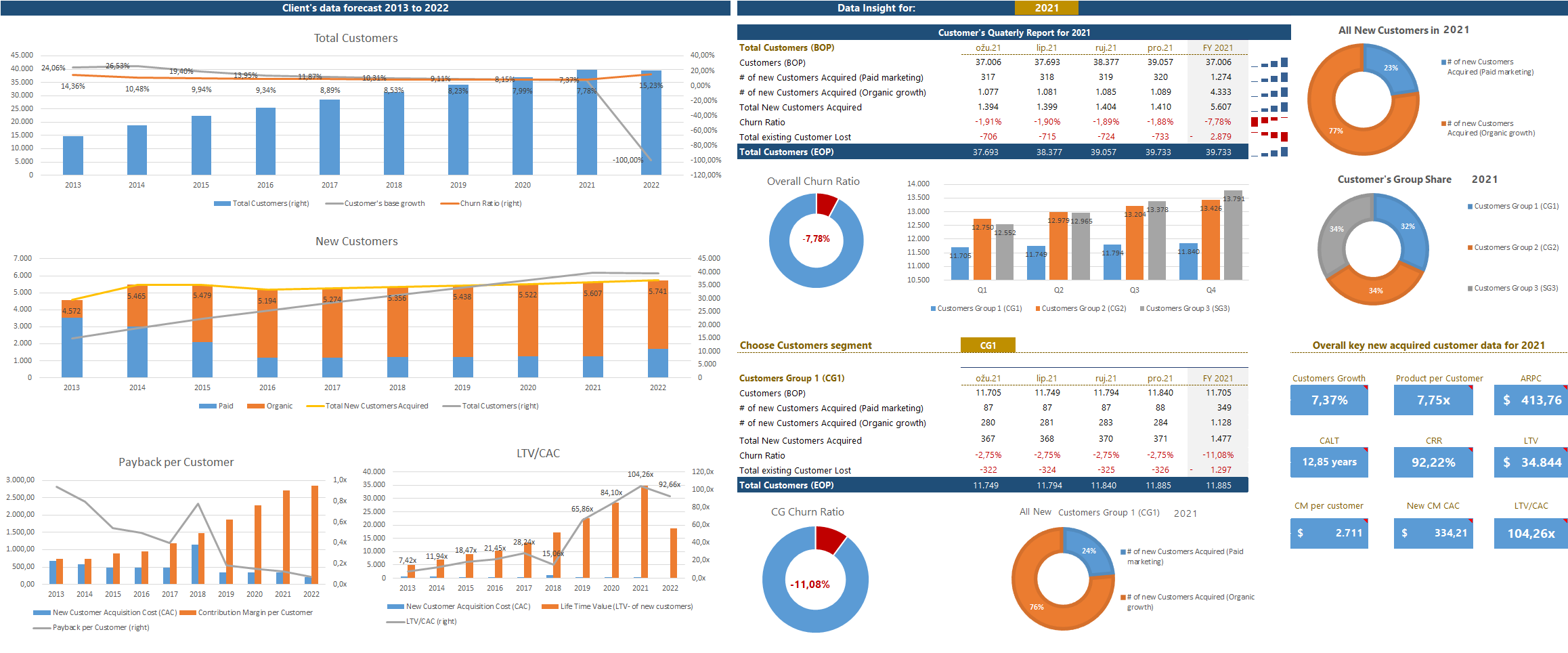

- Dynamic 5 Dashboards and detail insight into the yearly forecast on a quarterly basis

Startup assumptions

So you want to build a financial plan with key performance indicators (KPIs) for the next 5 or 10 years and also want to know how much your idea or startup might have an intrinsic valuation in money terms. This financial model can help you in modeling your startup and guide you through fine adjustment in all 15 modeling blocks.

All financial plans and valuations are built from financial and operational assumptions (or so-called drivers) in key business areas. Key assumptions can be derived from your known experience, researching other businesses operating on the same market segment, or playing with some known assumption in order to find the desired outcome by setting parameters for the rest of the unknown assumptions.

In order to derive planned financial line items, every assumption has several attributes:

- Main unit cost or price of the product

- numbers of units

- starting date and ending date of occurrence

- yearly increase based on current year

- additional seasonality attributes for estimating the number of customers and revenue from customers.

All financial plans and valuations are built from financial and operational assumptions (or so-called drivers) in key business areas. Key assumptions can be derived from your known experience, researching other businesses operating on the same market segment, or playing with some known assumption in order to find the desired outcome by setting parameters for the rest of the unknown assumptions.

In order to derive planned financial line items, every assumption has several attributes:

- Main unit cost or price of the product

- numbers of units

- starting date and ending date of occurrence

- yearly increase based on current year

- additional seasonality attributes for estimating the number of customers and revenue from customers.

Big Picture

One of the main drawbacks, when a business owner is doing financial planning in MS Excel developed for financial analysts, is losing the big picture over the overall business story.

In order to keep an eye on the business story of how you want to develop your business, we have build 5 Dynamic Dashboards for you to overlook the progress of your financial plan. Dashboards cover 5 important areas of your business to watch closely, such as customers, revenue, finance, operation, and business valuation.

In order to keep an eye on the business story of how you want to develop your business, we have build 5 Dynamic Dashboards for you to overlook the progress of your financial plan. Dashboards cover 5 important areas of your business to watch closely, such as customers, revenue, finance, operation, and business valuation.

Main Dashboard

Customer Dashboard

Let's go

Lastly, before you start entering your key assumption upon a financial plan will be built, it is advisory that you spend quite a time developing your business idea and execution strategy you will apply in order to reach out the desired business goal that will be outlined by the financial plan. Many users of the financial model for startups have developed detailed business models by using Business Model Canvas (BMC) or similar tools.

Lets start with section Preparation

Lets start with section Preparation